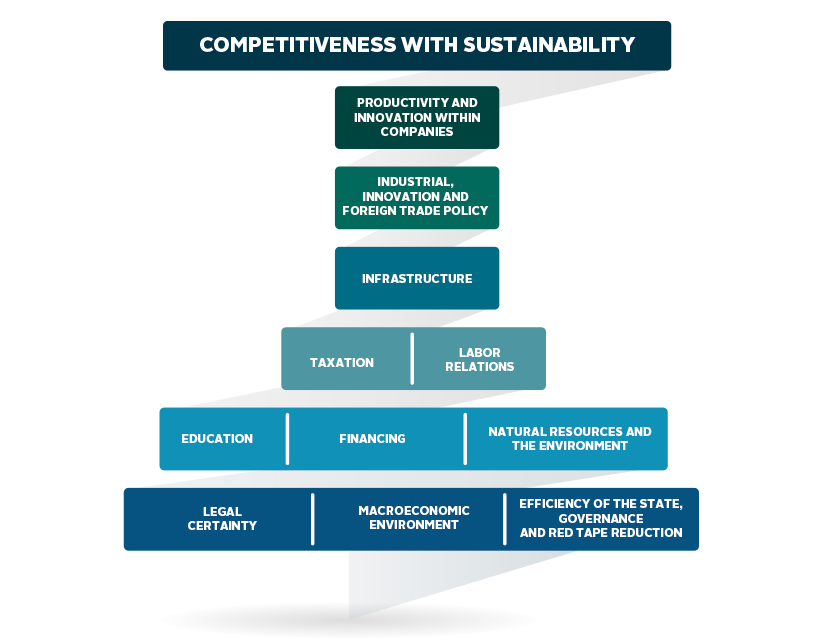

Taxation

Why Taxation?

Paying taxes is a major element of the social contract. However, the level of taxes, their assessment basis, the method used for calculating them and the obligations attached to them must be negotiated with society. The costs involved in paying taxes must be minimized for companies, as well as distortions in the allocation of productive resources caused by changes in the relative prices of goods and inputs.

The Brazilian tax system is burdensome, complex and involves excessive red tape, generating high costs for paying taxes and legal uncertainty. This reduces the competitiveness of companies and discourages investments in the country, negatively affecting the international integration of the Brazilian economy.

The cumulative nature of some taxes prevents the full recovery of credits along productive chains and is equivalent to a cost increase for companies. The sectors most affected by this accumulation of taxes are closer to the final links of value chains, which constitutes a disincentive to producing higher value-added goods. Cumulativeness also prevents full tax exemption for exports, thus increasing the prices of Brazilian products on the international market.

VISION FOR 2022

Most of the distortions of the Brazilian tax structure are no longer present. Taxes on value added have been consolidated and harmonized, promoting a more homogeneous standard. Taxes are not cumulative and entrepreneurs actually receive all tax credits from taxes levied in prior stages of the production chain. Recovery of fiscal balance combined with greater productivity of public spending paves the way for resuming the agenda on reducing the tax burden.

How we are doing?

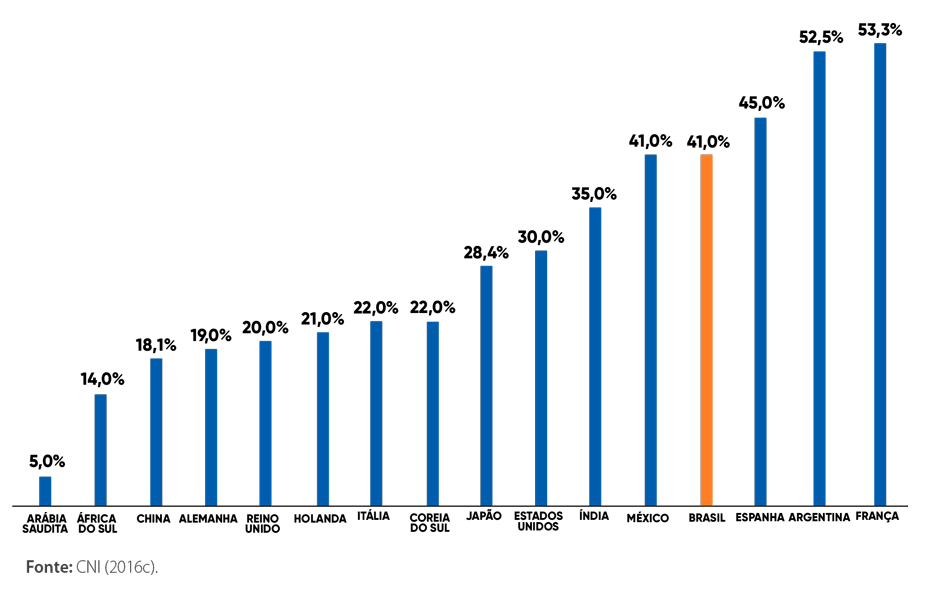

Brazil was ranked 15th among 18 countries in the Tax burden factor of the report

Competitividade Brasil 2017-2018: comparação com países selecionados.

Where do we want to get to?

Main Goal: Simplifying the Brazilian Tax System by reducing the number of taxes

Macro objective: Reducing the number of taxes on the circulation of goods and services (VAT) to two at most

PRIORITY TOPICS

QUALITY OF THE TAX SYSTEM

The Brazilian tax system needs to be revamped to eliminate distortions that discourage investment and reduce competitiveness

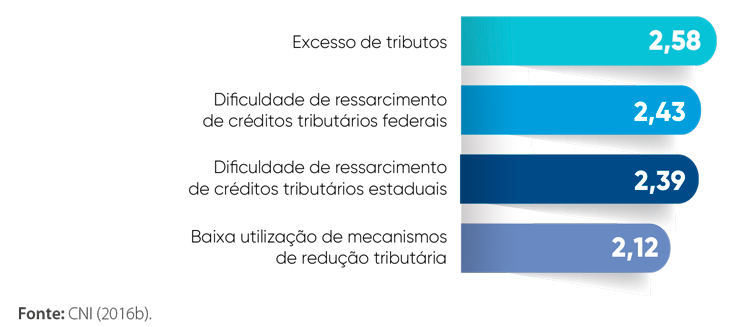

Tax cumulativeness and taxation of exports are among the main problems of the indirect taxation system in Brazil. These problems are caused by shortcomings in the credit and debit regime in connection with intermediate product transactions. These shortcomings increase the prices of products in the final links of value chains, stimulate verticalization and limit competitiveness gains associated with specialization in production stages.

Exports are discouraged both by credits lower than the amounts actually levied in the production chain and by delays in returning them. According to CNI (2014), 60% of Brazil’s largest exporting companies reported that the accumulation of tax credits affects exporting decisions.

Investment taxation is another feature of the tax system that puts Brazil at a disadvantage. The Brazilian tax model needs to be more in line with that adopted by its partners and competitors, under which investment is exempt from taxation and tax credits related to the purchase of capital goods are returned to companies expeditiously.

State taxation is also a source of inefficiencies. The ICMS (VAT) tax has a series of characteristics that generate distortions and compromise the competitiveness of companies operating in the different units of the federation: taxation on capital goods, physical credit system, commodity-limited taxation base, mixed taxation between origin and destination, difficulties to recover tax credits on exports, and excessive use of the tax substitution mechanism.

These characteristics, compounded by the excessive use of tax incentives, hinder sales between states and prevent companies from taking advantage of one of the main competitive advantages offered by Brazil, namely, the size of its domestic market.

LEVEL OF CRITICALITY OF EXPORT TAX OBSTACLES

Goals

Eliminating cumulative taxes and ensuring tax exemptions for exports of goods and services

OBJECTIVE

OBJECTIVE

Reducing the percentage of revenues from cumulative taxes from 6.8% to 0.0%

![]() INICIATIVES

INICIATIVES

- Implementation of comprehensive crediting mechanisms for indirect taxes

- Incorporating the ISS tax (on services) into the ICMS tax (VAT)

- Automatic compensation of credit balances of indirect taxes

- Compensation for non-recoverable taxes on exports

Exempting investment from taxation

OBJECTIVE

OBJECTIVE

Reducing the percentage of tax costs in the total value of an investment project from 17.1% to 8.0%

![]() INICIATIVES

INICIATIVES

- Improved use of tax credits on investment projects

- Lower incidence of non-compensable taxes on investments

- Improving income taxation to encourage investment

Eliminating distortions in state taxation on consumption of goods and services

OBJECTIVE

OBJECTIVE

Reducing the number of direct unconstitutionality lawsuits related to the ICMS tax pending judgment from 130 to 40

![]() INICIATIVES

INICIATIVES

- Improvement and national unification of the ICMS tax law, transferring the tax to the state of destination

- Regularization of ICMS tax incentives

- Limiting the use of the tax substitution mechanism for the ICMS tax

TAXATION ON FOREIGN TRADE AND INTERNATIONAL INVESTMENT FLOWS

Improving taxation on foreign trade and investment flows is necessary to broaden Brazil’s integration into the world economy

The inadequacy of the Brazilian laws on taxation on foreign trade in goods and services and on the international flow of investments makes it difficult for Brazil to integrate into the world economy.

Brazilian laws on taxation of profits made abroad are rigid and onerous and Brazil is one of the few countries that tax profits made abroad. Combined with a small number of agreements to avoid double taxation, the current legislation discourages investment flows and inhibits the establishment of operating bases for multinational companies in Brazil and for Brazilian companies abroad.

A Brazilian company that decides to operate abroad is forced to compete under less favorable conditions than those available to its competitors. Therefore, taxation on profits, transfer pricing standards and agreements to avoid double taxation should be aligned with the best international benchmarks and practices.

The growing specialization of the global industry in stages of the production process has increased the importance of services, which are essential to keep the chain together and to ensure the integration of its different stages efficiently, regardless of their physical location. Industry has been changing its business model, incorporating more and more services designed to add value to its products.

The Brazilian tax system for services is marked by various distortions and it ignores the importance of services for the competitiveness of industry and its integration into global value chains. Brazil needs to review its taxation system for imports and exports of services.

TAX BURDEN ON IMPORTED SERVICES

Goal

Improving tax standards with the aim of expanding international trade and investment flows

OBJECTIVE

OBJECTIVE

Entering into more double taxation agreements (DTAs), increasing the share in global GDP of countries with which Brazil has DTAs, from 46.5% to 50.0%

![]() INICIATIVES

INICIATIVES

- Improvements in income taxation and in its compatibility with OECD standards (BEPS)

- Improvements in taxation of imported goods and services

- Improvements in special customs procedures

SIMPLIFICATION AND TRANSPARENCY

Simplifying the Brazilian tax system is a key measure for improving competitiveness

The Brazilian tax structure is very complex. It includes many rules and more than one tax is levied on the same basis - on added value, for example, the ICMS (VAT), IPI (Tax on Industrial Products), PIS/PASEP (Social Integration Program/Public Servants’ Fund Financing Program) and COFINS (Social Security Financing Contribution) taxes and contributions are levied. In the case of corporate income taxation, two distinct taxes are levied: the Income Tax (IR) and the Social Contribution on Net Income (CSLL).

The costs for companies to remain compliant with this complex tax system are high. Companies are forced to spend on tax planning to minimize financial costs and not to run the risk of becoming non-compliant.

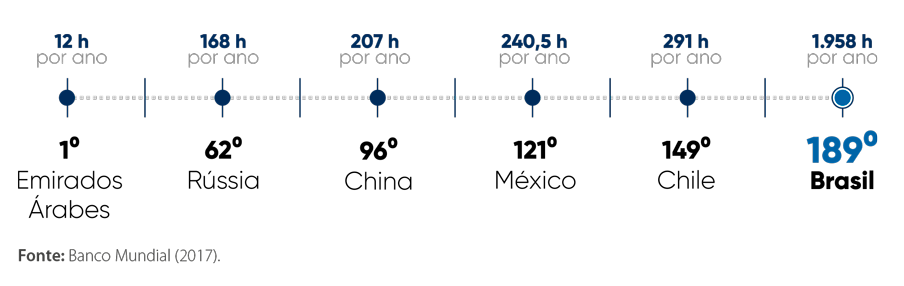

Brazil was ranked last in the item related to time spent paying taxes of the survey Doing Business 2018 (WORLD BANK 2017). Brazilian companies spend, on average, 1,958 hours a year paying taxes. This time is almost twice the time spent in Bolivia, which was ranked one before last.

Simplifying the Brazilian tax system is a key measure for reducing corporate costs and legal uncertainty.

RANKING OF TIME SPENT PAYING TAXES

Goal

Reducing the financial and ancillary costs associated with tax payments (cost of compliance)

OBJECTIVE

OBJECTIVE

Reducing the amount of hours spent paying taxes from 1,958 to 1,300 hours

![]() INICIATIVES

INICIATIVES

- Extending tax payment deadlines

- Eliminating the incidence of taxes on other taxes and on themselves

- Simplifying federal and state ancillary obligations

KEY FACTORS

Click on each key factor below to learn more about the Map