Financing

Why Financing?

An efficient financial system is essential for ensuring that capital is efficiently allocated, that is, for capital to be productive and contribute to the country’s growth.

Financing plays a fundamental role in promoting the growth of enterprises, as it enables investment in new plants, in machinery and equipment, in research and development etc.

In addition, it is important for the daily operation of companies, which rely on loans to pay their suppliers and workers when there is any mismatch between production and billing.

Brazilian companies still face difficulties to finance their production activities and their sales and exports. Insufficient finance at high costs and/or inappropriate payment deadlines hinder investment projects and, consequently, economic growth.

VISION FOR 2022

Companies with easier access to credit at lower costs as a result of financial innovations and increased bank competition. Greater participation of third parties in financing investments of industrial companies of all sizes. A more developed capital market characterized by interaction between a large number of diverse institutions. Greater availability of long-term financing in Brazil, as well as of finance for exports, innovation and MSMEs. Companies and individuals less dependent on public banks, operating according to a new definition of business activities and roles.

How we are doing?

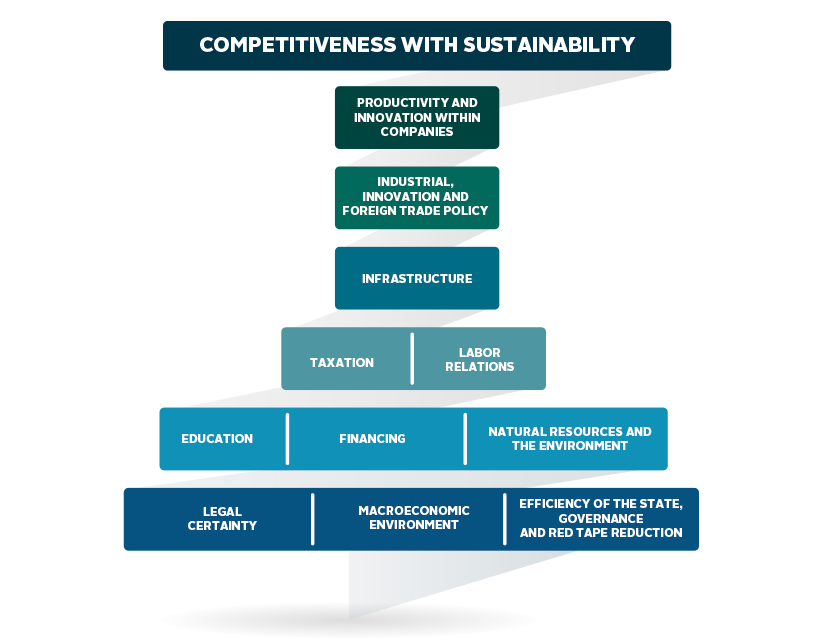

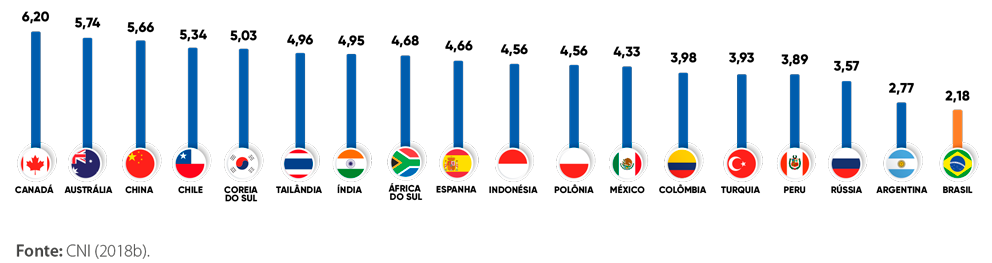

Brazil was ranked last among 18 countries in the Availability and Cost of Capital factor, according to the report Competitividade Brasil 2017-2018: comparação com países selecionados.

RANKING OF THE AVAILABILITY AND COST OF CAPITAL

Where do we want to get to?

Main goal: Improving companies’ access to investment resources

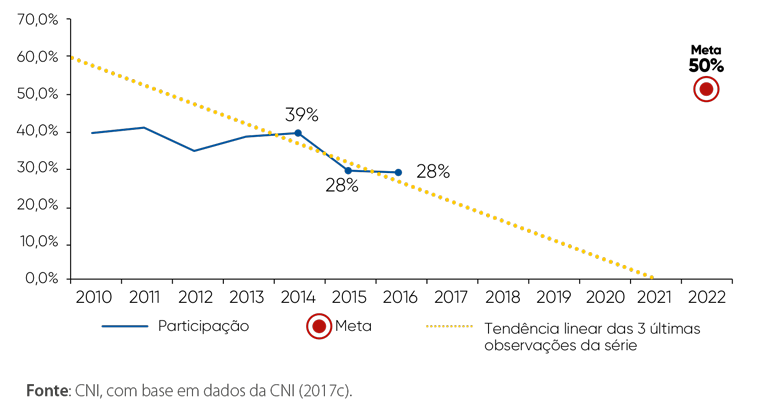

Macro objective: Increasing the share of third-party funding for investments of industrial companies from 28% to 50%

SHARE OF THIRD-PARTY FUNDING FOR INVESTMENTS OF INDUSTRIAL COMPANIES

PRIORITY TOPICS

BANK FINANCING

Increasing access to low-cost bank financing is one of the ways to enhance the competitiveness of industry

High real interest rates as compared to international standards (particularly for working capital) and insufficient long-term credit and stable sources of finance are the main factors hampering the financing of industry.

Despite an increase in the credit/GDP ratio in recent years, international comparisons show that there is room for credit to grow in Brazil, as it accounts for 111.2% of GDP currently against 192.1% on average in OECD countries, according to the World Bank.

Despite the recent reduction in the Selic rate, Brazil is still one of the countries with the highest real interest rates in the world.

In addition to high costs, repayment deadlines - which are rather short - also constitute an obstacle to financing for investment in Brazil.

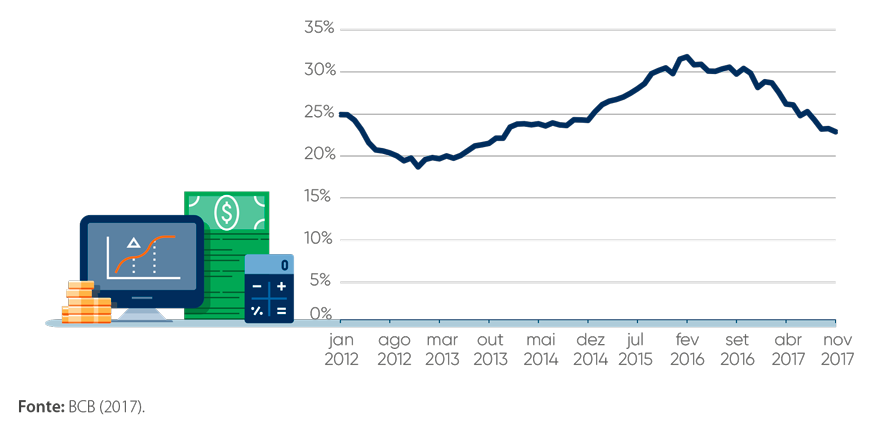

AVERAGE INTEREST RATE ON CREDIT OPERATIONS WITH NON-EARMARKED FUNDS - COMPANIES

Goals

Increasing the amount of bank financing

OBJECTIVE

OBJECTIVE

Increasing the balance of the loan portfolio in relation to GDP from 24.7% to 30.0%

![]() INICIATIVES

INICIATIVES

- Drafting of proposals for developing new alternatives for long-term private financing

- Increased bank financing for industrial companies

Reducing interest rates for companies

OBJECTIVE

OBJECTIVE

Reducing interest rates for companies from 27% to 15% per annum.

![]() INICIATIVES

INICIATIVES

- Reducing banking spreads

- Reducing credit costs for companies

NON-BANK FINANCING

Non-bank funding sources are alternatives with great potential to ensure greater access to funds by industry

Other financing mechanisms, apart from bank financing, may be lower-cost alternatives for the productive sector.

Accounting data from industrial companies show that the cost of capital for publicly-held companies is lower than for privately-held ones.

However, the corporate fixed income and stock markets are options that have not been appropriately explored by Brazilian companies for financial leverage so far.

Other funds, such as private equity, venture capital and fintech, are under development in the country and have great potential to grow.

Increased access to non-bank sources of finance for enterprises is hampered by regulation, low investor training and high operational costs.

In addition, it is necessary to make a large part of the public more aware of how these credit alternatives work as a financing instrument.

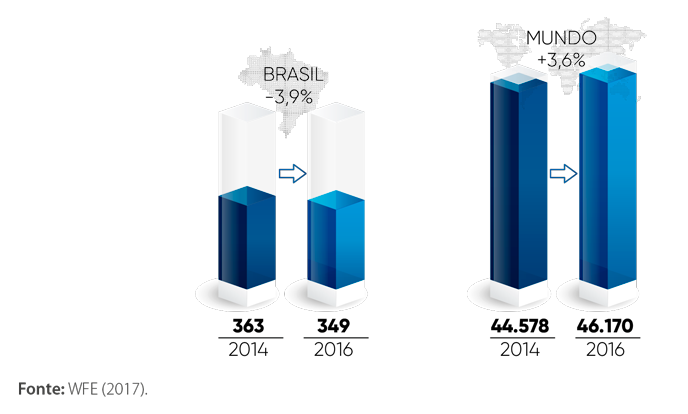

NUMBER OF COMPANIES LISTED ON THE STOCK MARKET

Goals

Expanding the corporate fixed income market

OBJECTIVE

OBJECTIVE

Increasing the ratio of total debentures in relation to GDP from 0.67% to 1.50%

![]() INICIATIVES

INICIATIVES

- Promoting the issuance of corporate bonds and increased liquidity in secondary markets

- Drafting proposals to increase the participation of public and development banks as drivers of long-term corporate credit

- Promoting long-term investment funds

Developing the stock market

OBJECTIVE

OBJECTIVE

Increasing the number of listed companies from 349 to 480

![]() INICIATIVES

INICIATIVES

- Facilitating access to and reducing IPO costs

Increasing access to new financing mechanisms

OBJECTIVE

OBJECTIVE

Increasing the committed capital of the private equity and venture capital industry from 2.3% to 4.0% of GDP

![]() INICIATIVES

INICIATIVES

- Promoting private equity, venture capital, angel investment and fintech funds

- Regulating corporate collective investment

COLLATERAL

High demand for real collateral is one of the factors limiting access to credit by industrial companies

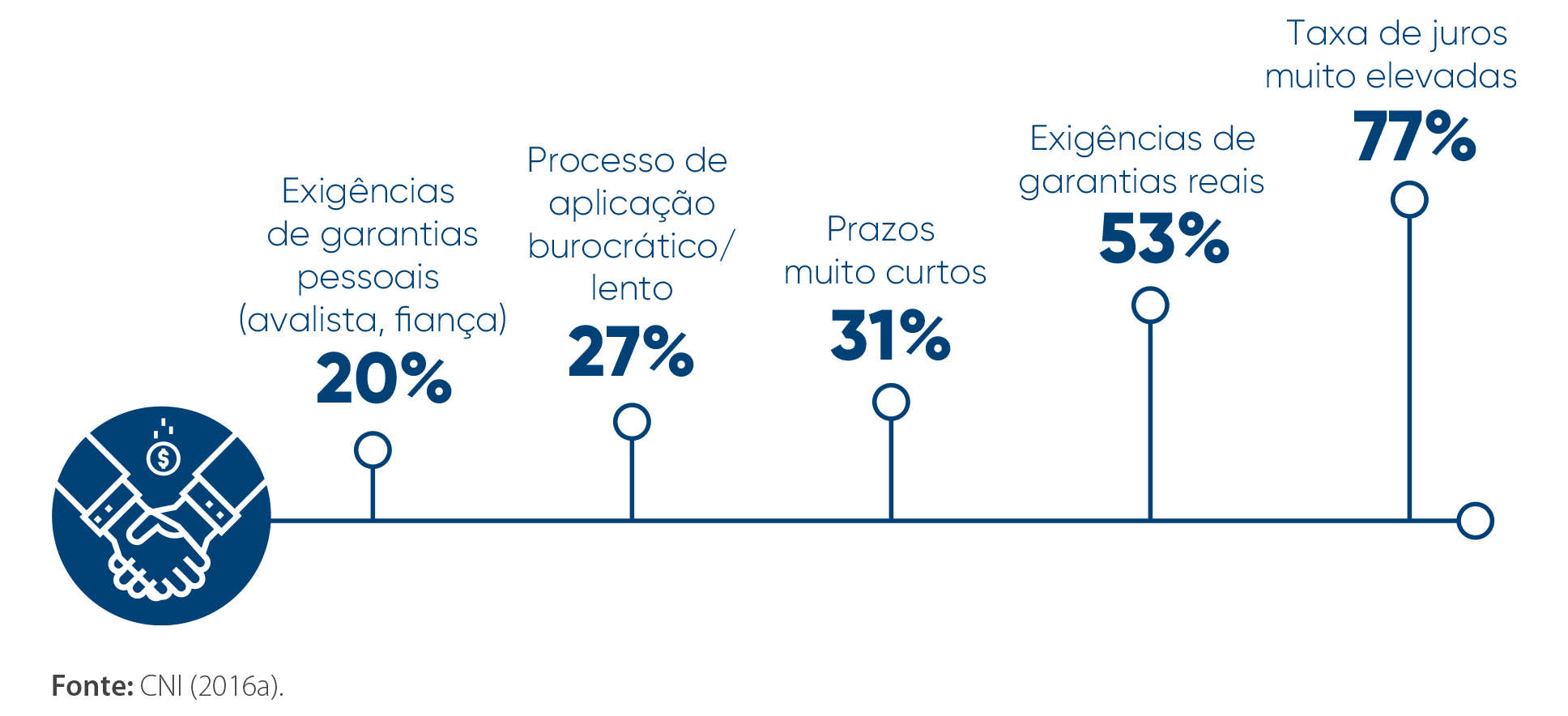

The main difficulties faced by industrial companies applying for credit include the requirements and complexity involved in providing real collateral, submitting the required documents and updating credit ratings.

Brazil got a score of 2.0 in the Judicial System Efficiency Index of the 2018 Doing Business survey (WORLD BANK 2017), which measures the extent to which collateral and bankruptcy laws protect the rights of borrowers and lenders, thereby facilitating lending. The score is lower than that of Latin America and Caribbean countries (5.4) and of OECD countries (6.2). This is one of the factors that places Brazil in the 105th position in the ranking for ease of obtaining credit.

Access to specific financing lines, such as for exports and investments abroad, is also hampered by collateral requirements, according to the survey Challenges to the competitiveness of Brazilian exports (CNI, 2016b).

Ensuring easier access to collateral systems is an important step toward increasing investment and exports.

MAIN DIFFICULTIES FACED BY INDUSTRIAL COMPANIES WHEN APPLYING FOR CREDIT

Goal

Facilitating the access of companies to the credit collateral system

OBJECTIVE

OBJECTIVE

Improving Brazil’s score on ease of access to credit from 3.5 to 5.5

![]() INICIATIVES

INICIATIVES

- Improving the national collateral system

- Reducing requirements for companies with a positive credit record

- Improving collateral instruments for exports and investments abroad

- Simplifying procedures for accessing credit for innovation

- Improving collateral systems for micro, small and medium-sized enterprises

FINANCING FOR INNOVATION, EXPORTS AND MSMEs

The development of industry depends on the provision of specific financing instruments for innovation and exports and increased access to such mechanisms by micro, small and medium-sized enterprises

Due to their particularities, some activities and groups of companies need specific credit lines.

Innovation depends on specific financing mechanisms adapted to the risks inherent in innovative activity. Instruments for allocating public funds to innovation must be strengthened and improved and new financing sources for the National Innovation System must be sought. In addition, the allocation of resources from development funds should be fully linked to technological development and innovation.

Export financing requires specific mechanisms that take into account uncertainties related to exchange rate variations, political risks and financial support from foreign governments to their exports. For Brazilian companies to be able to compete in the international market, processes must be simplified and export financing mechanisms must be improved.

Micro, small and medium-sized enterprises (MSMEs) face operational difficulties derived from their low organizational level and low scale of production or from difficulties to access knowledge. MSMEs face greater difficulties to access finance as compared to large companies. The main obstacles they face include high transaction costs for loans, information asymmetries and lack of real collateral.

The availability, consistency and continuity of specific financing mechanisms of this kind must be ensured.

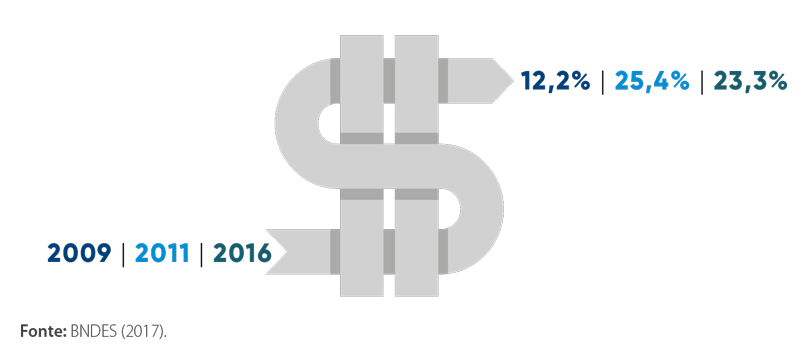

SHARE OF LOANS TO MICRO AND SMALL COMPANIES IN NATIONAL ECONOMIC AND SOCIAL DEVELOPMENT BANK (BNDES) ANNUAL DISBURSEMENTS

Goals

Improving mechanisms to facilitate access to financing and incentives for innovation

OBJECTIVE

OBJECTIVE

Increasing the share of industrial companies that promoted innovations with public financing in relation to the total of industrial companies that innovated from 33.8% to 50.0%

![]() INICIATIVES

INICIATIVES

- Improving innovation financing mechanisms

- Strengthening the Brazilian Company for Research and Industrial Innovation (EMBRAPII) in its pre-competitive R&D activities

- Improving the rules applied to compulsory investment in R&D in regulated sectors

Expanding export financing

OBJECTIVE

OBJECTIVE

Increasing the percentage of exports relying on specific financing lines from 40% to 50%

![]() INICIATIVES

INICIATIVES

- Improving funding lines

- Improving the governance of the export financing system

- Expanding commercial banks share in export financing

Increasing credit lines available to micro, small and medium-sized enterprises

OBJECTIVE

OBJECTIVE

Increasing BNDES financing for MSMEs from R$25.2 million to R$40.0 million in constant reals of 2014

![]() INICIATIVES

INICIATIVES

- Implementing financial education programs for micro, small and medium enterprises

- Standardizing documents and requirements for credit analysis

- Improving and disseminating the credit mentoring service

KEY FACTORS

Click on each key factor below to learn more about the Map